Required minimum distribution 2021 calculator

Distribution of Information Regarding Advance Payments of the Premium Tax Credit APTC and Cost-Sharing Reductions CSR in Federal Standard Notices for Coverage Offered through the Federally-facilitated Marketplaces PDF. A computer is a digital electronic machine that can be programmed to carry out sequences of arithmetic or logical operations computation automaticallyModern computers can perform generic sets of operations known as programsThese programs enable computers to perform a wide range of tasks.

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

2021-2022 Tax Brackets.

. As of early 2021 though required minimum distributions were restored. Most annuity companies recognize this unique scenario and will waive surrender charges if the RMD amount is larger than the penalty-free withdrawal. If you were born on July 1 1949 or later your RMD will be made in the year you.

A computer system is a complete computer that includes the hardware. Learn more about required minimum distributions for Traditional IRAs and use T. This is called a required minimum distribution RMD.

Use our Inherited IRA RMD Calculator to estimate your minimum withdrawal. If you want to download this RMD table for an Excel spreadsheet just highlight and copy the table and then in your spreadsheet select paste special and unicode text. However IRS guidance clarified that the April 1 2020 distribution has also been waived.

Once you turn 72 you must begin withdrawing a set amount each year called a required minimum distribution whether you need the income or not. Roth IRA Contribution Rules. 1970 to December 31 st 2021 the.

See Form W-2 under Credit for Withholding and Estimated Tax for 2021 in chapter 4. Paul must receive his 2022 required minimum distribution by December 31 2022 based on his 2021 year-end balance. Minimum Value Calculator Methodology PDF Guidance.

The distributions are required to start when you turn age 72 or 70 12 if you were born before 711949. December 16 2011. This amount also known as your Required Minimum Distribution RMD is determined by your age and account balance so it changes each year.

Consequence for failing to take required minimum distributions If you do not take any distributions or if the distributions are not large enough you may have to pay a 50 excise tax on the amount not distributed as required. However the applicable minimum age is lowered further for former foster youth and qualified homeless youth to age 18. The RMD rules dictate when distributions must be made from the retirement plans of certain taxpayers.

The percentage of the retirement account that must be distributed each year is not fixed. Your required minimum distribution is the minimum amount you must withdraw from your account each year. An RMD is the annual Required Minimum Distribution that you must.

The SECURE Act of 2019 changed the age at which RMDs must begin. If you are under 17 years old and have an out-of-state drivers license you will not be required to provide proof of driver training and the supervised driving period will not be required. You can use Vanguards RMD Calculator to estimate your future required distributions when youre putting together your retirement income plan.

The required minimum distribution RMD rules limit the extent to which an individual can use the tax deferral of an IRA or other qualified retirement plan. Rowe Prices RMD calculator to estimate your annual distribution amount. If you do not want to take your RMD because you dont need the income theres good news.

On July 27 2021 you enroll in family HDHP coverage and on August 17 2021 you make a qualified HSA funding distribution. Budgeting Calculator Financial Planning Managing Your Debt Best Budgeting Apps Investing. 2022 RMD Update The IRS released final regulations effective January 1 2022 updating the lifetime distribution tables which should be used for calculating 2022 Required Minimum.

Once you stop working for a Wisconsin Retirement System employer federal law requires you to begin receiving your benefit payments by a certain date depending on your age. Single Life Expectancy. The RMD rules dictate when distributions must be made from the retirement plans of certain taxpayers.

This calculator has been updated for the SECURE Act of 2019 and CARES Act of 2020. In these cases the minimum age has been lowered to age 19 except for specified students who must be at least age 24 at the end of the year. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020.

Westend61 GettyImages. The calculator will project your RMDs for all future years when you enter your estimated rate of return. Sometimes the surrender charge period coincides with an annuity owners required minimum distribution period.

Therefore if you turn 72 in 2021 wait until March 31 2022 to make your first RMD youll have to take another RMD in December 2022. So heres how it works now taking into account the 2020 suspension and the new age for RMDs. This can be very useful when youre tax planning for retirement because larger distributions.

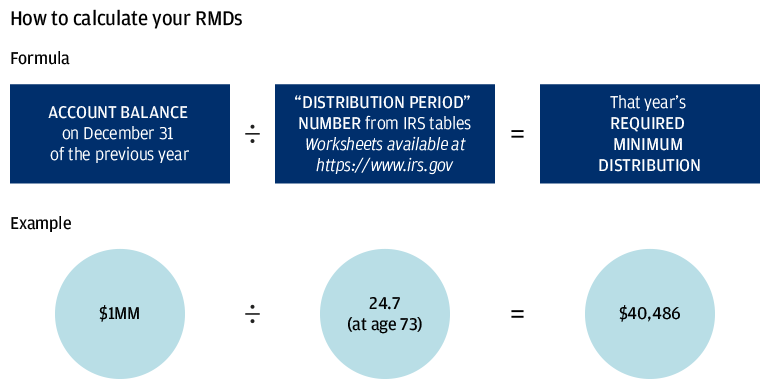

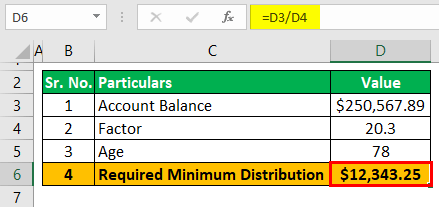

The analysis provided by this tool is based solely on the information provided by you. You generally have to start taking withdrawals from your IRA SEP IRA SIMPLE IRA or retirement plan account when you reach age 72 70 ½ if you reach 70 ½ before January 1 2020. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec.

If you were born on or after July 1 1949 your first would have been required by April 1 2021. The required minimum distribution RMD rules limit the extent to which an individual can use the tax deferral of an IRA or other qualified retirement plan. The required minimum distribution rules apply to qualified annuities.

An out-of-state drivers license may be used for 90 continuous days from the time an Idaho domicile is established before an Idaho drivers license. This calculator helps people figure out their required minimum distribution RMD to help them in. If you have multiple IRAs you must calculate each account individually but you can take your total RMD amount from one IRA or a combination of IRAs.

2021 2022 Actuarial Value Calculator. The required minimum distribution table rmd table for those who reach age 70 and the rmd table for beneficiaries are printed below. If you were taking RMDs regularly before the 2020 suspension you need to resume taking your annual RMD by Dec.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. Retirees who are age 72 or above are required by the IRS to take a minimum distrubtion annually. Roth and Traditional IRA Contribution Limits for 2021 and 2022.

The SECURE Act changed the age at which an RMD is required to start to age 72. Your testing period for the first distribution begins in June 2021 and ends on June 30 2022. Your testing period for the second distribution begins in August 2021 and ends on August 31 2022.

A Comprehensive Guide. 2022 Retirement RMD Calculator Important. Although you cant roll.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. A required minimum distribution is a specific amount of money a. Use this calculator to determine your required minimum distributions RMD from a traditional IRA.

Buy Car Calculator. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July. The deadline for your first RMD is April 1 but all subsequent RMDs are due December 31.

2021 Rrif Withdrawal Rates 2021 Rrif Minimum Withdrawal Payout Schedule Lifeannuities Com

Required Minimum Distribution Calculator Estimate The Minimum Amount

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2022 New Irs Required Minimum Distribution Rmd Tables

Required Minimum Distributions Rmds Are You Ready

Why Taking Rmds On Time Is So Important J P Morgan Private Bank

Rmd Table Rules Requirements By Account Type

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Rmd Table Rules Requirements By Account Type

Where Are Those New Rmd Tables For 2022

Taxtips Ca Rrsp Rrif Withdrawal Calculator

How To Calculate Rmds Forbes Advisor

Required Minimum Distribution Calculator Estimate The Minimum Amount

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Rmd Calculator Required Minimum Distributions Calculator

Required Minimum Distributions Rmds Youtube

Required Minimum Distribution Calculator Estimate The Minimum Amount